To Gift Or Devise, That Is The Question!

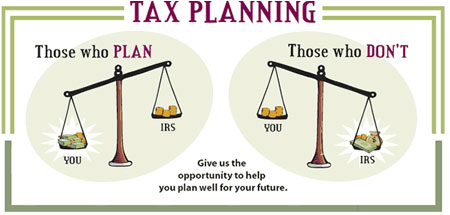

Tax and Estate Planning is Critical to Avoid Unnecessary Tax Burdens and Consequences

I have clients ask me all the time if it makes sense to give their property to their kids or should they wait to die and let their kids inherit it. The practical answer from a tax planning perspective is to allow the property to transfer at the time of death. If you haven’t spent any time planning your estate or your property succession strategy you should sit down and think about how you would like things to pass, and who should be the recipient of the properties. If you have a substantial estate with multiple properties chances are you already have done this, if not an estate planning or trust attorney can help you through this process. Planning now can prevent unnecessary taxes or burdens being placed on your loved ones.

Gifting a Property Has Unnecessary Tax Consequences

If a living parent gifts a piece of real property to their children the child receives the property with a tax basis the same as the parent. For example, if the parent purchased the home for $100,000 and at the time of the gift to the child the property was worth $1,000,000 the child would have a basis, for tax purposes, of $100,000. In California, if the child were to sell the home at that time they would have a capital gain of $900,000 and would have to pay capital gains taxes of 33% on the $900,000 of approximately $297,000. That wipes out about 1/3 of the value and frankly doesn’t make much sense.

Devising a Property Has Tax Benefits

If a living parent devises, or wills a piece of real property to their children at the time of the parent’s death, the child receives the property with a “stepped-up” tax basis of the value of the property at the time of the parent’s death. For example, if the parent purchased the home for $100,000 and at the time of the death of the parent the property was worth $1,000,000 the child would have a basis, for tax purposes, of $1,000,000. In California, if the child were to sell the home at that time they would have a capital gain of $0 and would have to pay $0 capital gains taxes. From a tax planning perspective this scenario makes much more sense than gifting the property to the child.

Tax and Estate Planning is Key to Long-Term Wealth Creation

If you and your family has accumulated multiple properties, stocks, bonds, and other investment vehicles such that your family net worth is more than a few million dollars it is paramount that you consult with a tax planning professional or trust attorney. There are dozens of tax planning and investment strategies designed to allow your family, your children and your grandchildren to benefit from your hard work well into the future. Without properly planning your estate, your children, and your grandchildren could end up being burdened with tax consequences which were completely avoidable. If you need a referral to a professional who can help you in this area please don’t hesitate to contact me anytime.